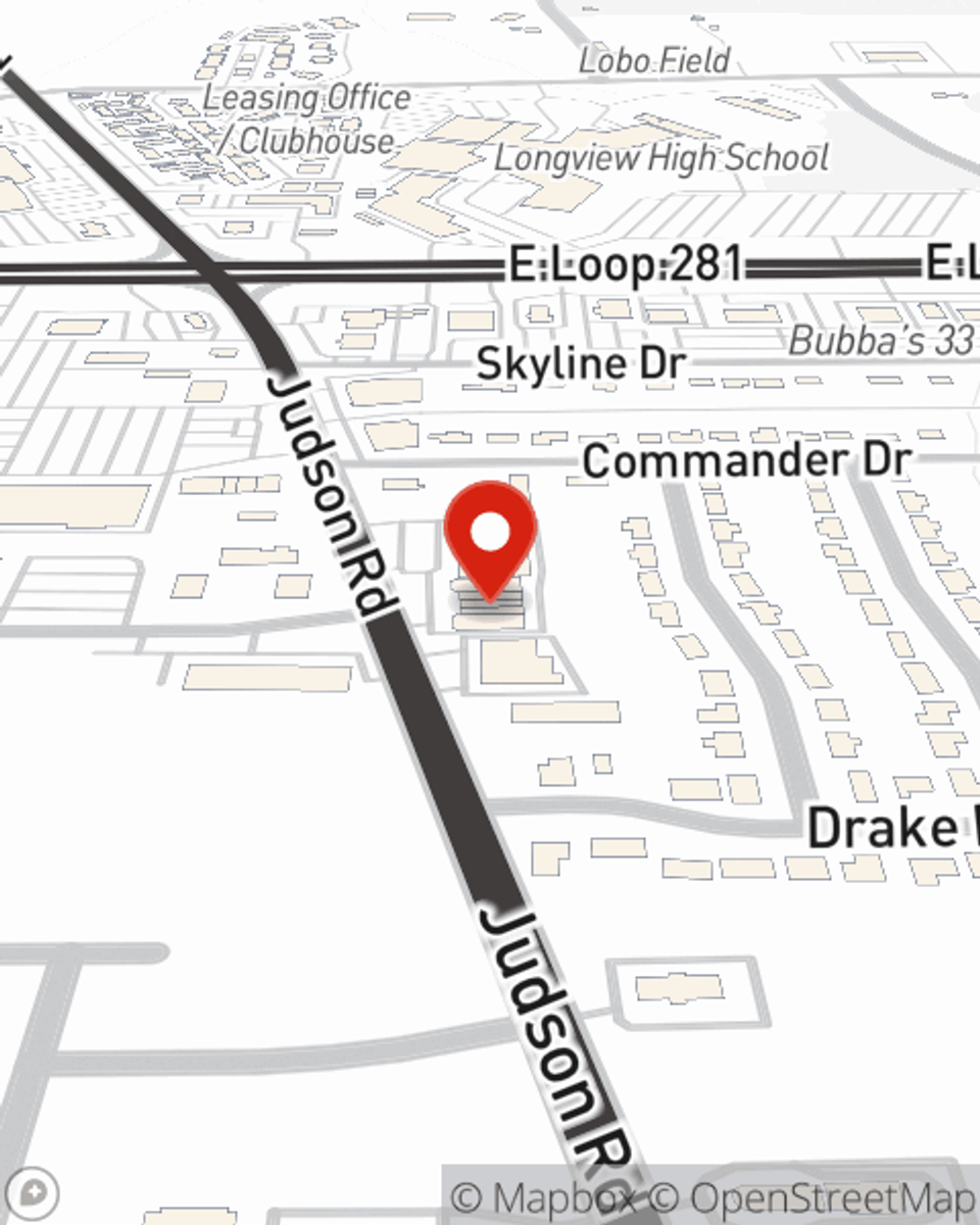

Homeowners Insurance in and around Longview

Looking for homeowners insurance in Longview?

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

Your home and possessions have monetary value. Your home is more than just a roof over your head. It’s all the memories you’ve made there. Doing what you can to keep your home protected just makes sense! And one of the most reasonable things you can do is to get excellent homeowners insurance from State Farm.

Looking for homeowners insurance in Longview?

Help protect your home with the right insurance for you.

Protect Your Home Sweet Home

State Farm's homeowners insurance guards your home and your belongings. Agent JJ Walnofer is here to help set you up with a plan with your specific needs in mind.

Your home is a big deal, but unfortunately, the unanticipated circumstance can happen. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. JJ Walnofer can help you get the home coverage you need!

Have More Questions About Homeowners Insurance?

Call JJ at (903) 663-4176 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Clothes dryer maintenance tips

Clothes dryer maintenance tips

These simple tasks can help extend the life of your dryer. Find out how to clean the inside of a dryer, how to clean your dryer vent and more.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

JJ Walnofer

State Farm® Insurance AgentSimple Insights®

Clothes dryer maintenance tips

Clothes dryer maintenance tips

These simple tasks can help extend the life of your dryer. Find out how to clean the inside of a dryer, how to clean your dryer vent and more.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.